November 12th at 8:40am by Tom Lydon

When investing in any exchange traded fund, one should have a clear strategy in place. Instead of relying on gut feelings or fight-or-flight instincts, investors can look at the trend lines to get a sense of when they should be in or out.

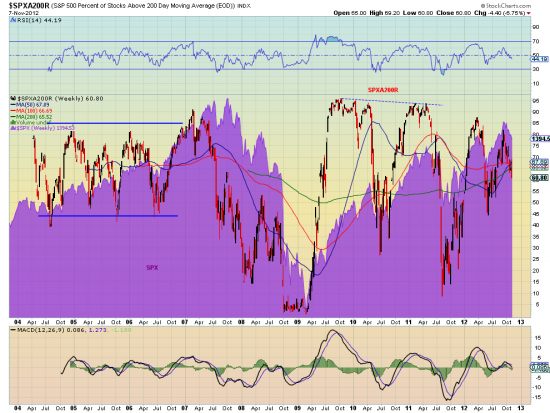

For instance, Greg Harmon for Dragonfly Capital tracks the percentage of stocks trading above their 200-day simple moving average, or SMA.

Harmon points to a nine year chart, with the purple background indicating the actual movement in the S&P 500.

Investors will notice that market bottoms typically occurred when the percentage of stocks over the 200-day SMA dipped below at least 45%. With a level of 60.8 today, Harmon cautioned that ?there is still room for a lot more downside.?

Here at ETF Trends, we look at an ETF?s 200-day exponential moving average to determine buy or sell positions. If the fund is above its 200-day EMA, it is positive signal, whereas if the fund decreases below the trend, it is an indicator to get out. [An ETF Trend-Following Plan for All Seasons]

Currently, most broad stock ETFs are hovering around or below their 200-day EMAs:

- SPDR S&P 500 ETF (NYSEArca: SPY): 0.7% above its 200-day exponential moving average

- Powershares QQQ Trust ETF (NYSEArca: QQQ): 1.7% below its 200-day exponential moving average

- SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA): 0.4% below its 200-day exponential moving average

- iShares Russell 2000 ETF (NYSEArca: IWM): 0.8% below its 200-day exponential moving average

For more information on tracking investment trends, visit our trend following category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

Source: http://www.etftrends.com/2012/11/investing-etfs-200-day-moving-average/

Lena Dunham peyton manning sf giants gold rush gold rush windows 8 Emanuel Steward

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.